Choosing a commercial property to buy or rent is completely different to selecting a home. Or is it? It could be said that aesthetic considerations are just as big a factor when selecting commercial property. In fact, investors actively look for buildings which will be attractive to tenants and their employees. After all, who wants to work in an ugly building? But can looks make a difference to the monetary value of a building?

Read more after the jump:

Classification of Commercial Property

Internationally, commercial property is placed in three different classes in order to provide investors with an easy reference system:

Class C: Buildings of more than 20 years in age, possibly in less desirable areas, which need plenty of work and are not visually appealing at all.

Class B: Buildings in the middle ground, which aren’t new and could possibly do with renovation.

Class A: These are the newest, best located and most physically attractive buildings.

As you can see from the above, how a building looks is vitally important in the classification of commercial property. But does this have a definite, measurable effect on the monetary value of the building?

Valuing Commercial Property

There’s only one way to really find out if a building’s aesthetics are affecting its worth and that’s to consult a commercial real estate firm like GVA. By doing this it’s possible to receive an expert valuation and the opinion of someone experienced enough to know what matters most when it comes to property prices. An assessor will consider the property using a professional valuation method such as:

The Comparable Method, comparing the property to others in the area.

The Profits Method, looking at the financial details of the property and only available if the property is currently or has been in use.

The Gross Rent Multiplier, which is considered to be the quickest method, dividing the selling price or value of a property by the property’s gross rentals.

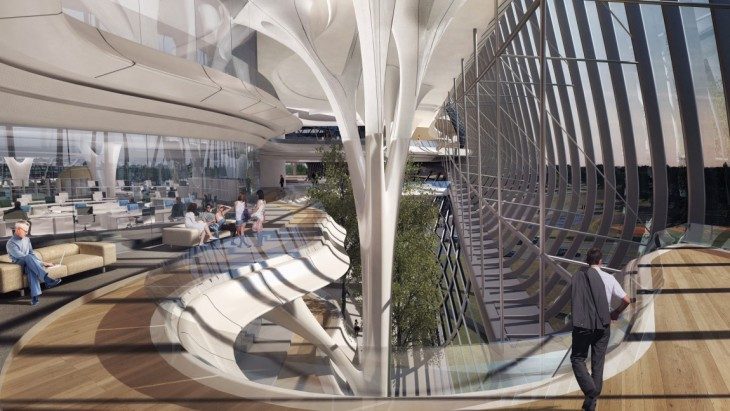

The Aesthetic X-Factor

The above methods may seem scientific, but it has to be said that valuing commercial property is also an art. That’s why expert assessors often include factors other than comparative values, sale prices and rents in their estimates. And these factors could have a lot to do with how properties look. Buildings with unique designs or stunning architectural features could possibly be bumped up

in value if all other factors, such as location and finish, are in place.

When we combine this observation with our knowledge that international investors actively categorise property into three bands, each based partly on aesthetics, we get a fuller sense of the story and an answer to our original question.

The way a commercial building looks can be as important as any other factor in determining its value.